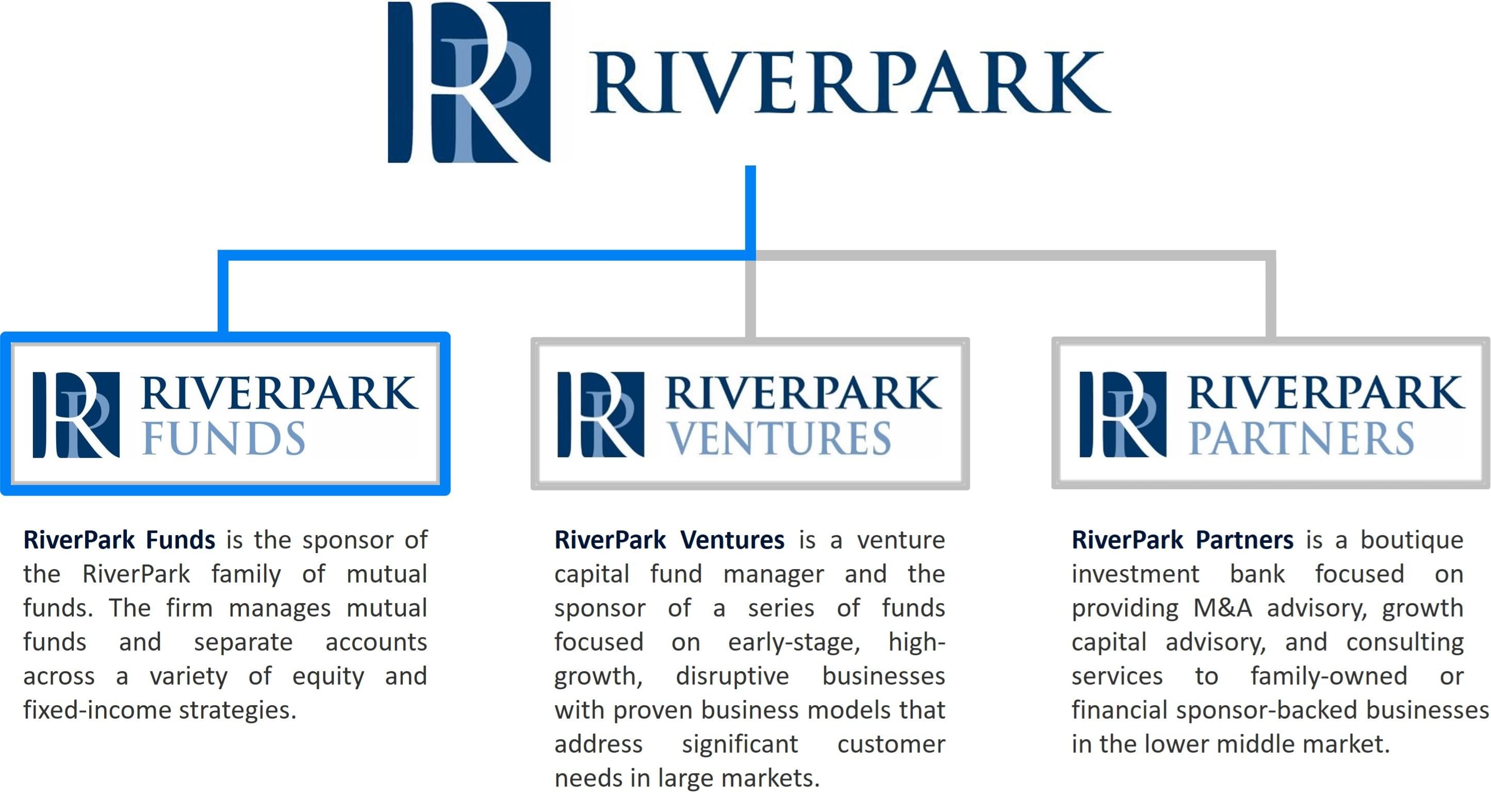

Founded in 2006, RiverPark is a financial services group with over $1 billion* in assets under management. RiverPark has decades of experience and success in launching and managing funds both in the public and private capital markets and has built strong back office, middle office and compliance functions.

* As of December 31, 2025.

History

RiverPark was founded in 2006. After initially focusing on institutional separate accounts, RiverPark Advisors, LLC was formed in July 2009 to launch the RiverPark family of mutual funds. RiverPark is 100% privately owned, with a majority held by employees.

September 2009

- RiverPark launches RiverPark Opportunity Fund as a hedge fund

September 2010

- RiverPark creates RiverPark Funds Trust

- RiverPark launches RiverPark Large Growth Fund, RiverPark Short Term High Yield Fund and Wedgewood Fund as mutual funds

March 2012

- RiverPark converts RiverPark Opportunity Fund to the RiverPark Long/Short Opportunity Fund as a mutual fund

September 2013

- RiverPark launches RiverPark Strategic Income Fund

June 2014

- RiverPark launches RiverPark Ventures, L.P.

September 2016

- RiverPark launches RiverPark Floating Rate CMBS Fund as an interval fund

- RiverPark launches RiverPark Ventures II, L.P.

November 2018

- RiverPark converts RiverPark Floating Rate CMBS Fund from an interval fund to a mutual fund

October 2019

- RiverPark launches RiverPark Ventures III, L.P.

July 2022

- RiverPark launches RiverPark Ventures IV, L.P.

June 2023

- RiverPark launches RiverPark/Next Century Growth Fund

January 2024

- RiverPark launches RiverPark/Next Century Large Growth Fund

January 2025

- RiverPark launches RiverPark Partners

Alignment of Interests

RiverPark believes strongly in investing alongside its shareholders. RiverPark portfolio managers and employees collectively have over $25 million invested in our own strategies.

Investment Philosophy

We are committed to building portfolios with strong fundamentals that aim to provide superior returns over multiple economic cycles. We are differentiated by our long-term perspective and our focus on research-driven strategies.